President Donald Trump is greeted by Japanese Prime Minister Sanae Takaichi at Akasaka

By Gina Hill | Alaska Headline Living | October 2025

1. U.S.–Japan Investment & Trade Pact Moves Into Implementation

The White House today published a follow-up to the July framework agreement with Japan, laying out concrete steps for implementation. Reuters+3White House+3InsideTrade+3

- Japan has pledged to invest US$550 billion into U.S. industries, as per the fact sheet, targeting sectors like semiconductors, critical minerals, pharmaceuticals, ship-building and more. KPMG+2Axios+2

- In return the U.S. will apply a baseline 15% tariff on nearly all Japanese imports, including key sectors like autos and parts. The deal also opens Japanese markets to U.S. agricultural exports (e.g., rice, corn, soybeans) and aerospace. Supply Chain Dive+2CSIS+2

- Implementation documents signal that although the deal is announced, many finer operational details remain unclear: how the investment will be directed, how the tariff changes will roll out, and how enforcement or contingency measures will work. CSIS+1

Why it matters:

This pact marks one of the largest bilateral investment commitments in U.S. history and a strategic recalibration of the U.S.–Japan economic relationship — showcasing a shift from purely trade to trade + industrial-investment. For U.S. firms, it means potential new access to Japanese markets; for Japanese firms, a major gateway into U.S. production. But the scale also raises serious questions: can the U.S. really absorb such a large inflow of investment productively? Will the 15% tariff be sustainable? How will Japanese exporters respond?

What to watch: When the investment vehicle opens for subscriptions, which U.S. states or industries get priority; how the U.S. automakers respond to 15% tariffs on Japanese vehicles; how Japan’s domestic politics reacts — especially its export-and-trade sensitive sectors.

2. UN Climate Review: “Improving” But Pace Insufficient

The United Nations Framework Convention on Climate Change (UNFCCC) released its 2025 NDC Synthesis Report today, analysing 64 countries’ newly submitted national climate plans (to 30 Sept 2025). UNFCCC+2UNFCCC+2

- The report notes a clear improvement in the “quality, credibility and economic breadth” of submitted plans, meaning more countries are including binding targets, broader sectors, and explicit budget lines. UNFCCC+1

- Yet, even if all these plans were fully implemented, the text and associated analysis suggest global emissions would fall by only about 17-24% relative to 2019 by 2035 — far short of the 60%+ reductions needed for a decent shot at limiting warming to 1.5 °C. WWF

- Regions flagged as especially behind include Africa (where many NDCs are still weak on finance & adaptation), Southeast Asia (where coal and LNG expansions continue), and Latin America (where deforestation remains a major driver). The report emphasises “implementation, finance flows and sectoral transitions” as the key bottlenecks. UNFCCC+1

Why it matters:

With the next major climate conference (COP30) looming, this report serves as a wake-up call: better plans won’t suffice unless action follows. Investors, firms, and policymakers globally now have fresh ammunition, both to argue for faster decarbonisation (especially upstream sectors like steel, cement, shipping) and to highlight potential stranded-asset risk.

What to watch: How major emitters respond to this, whether new “implementation acceleration” pledges surface prior to COP30, and how the finance community adjusts risk models for delay or insufficient ambition.

3. Euro Area Bank Lending Survey Signals Tighter Credit for Firms

A recent sub-analysis of the European Central Bank (ECB) Bank Lending Survey (though the formal BLS detail is still behind schedule) suggests euro-area banks gradually tightening credit standards for corporate lending, despite resilient demand for loans. Reuters+1

PC: European Central Bank 2025

- The Reuters summary reports that in Q3 2025 (survey of 154 banks) there was a “net tightening” of access to corporate credit, attributed to economic and trade-risks (especially Germany). Reuters

- At the same time, overall loan demand modestly increased (business investment/refinancing) and household lending remained steady or rose (housing mortgages demand is rising) — which suggests banks are discriminating more on judging risk rather than broad pull-back. Reuters+1

Why it matters:

This is a subtle but important barometer: tighter credit standards for firms may slow investment and undercut the growth rebound, even if headline growth remains positive. For policymakers, it raises questions whether current monetary-policy settings (lower rates) are translating into broader real-economy support, or whether structural/trade risks are dominating.

What to watch: The ECB’s formal release of the “October 2025” BLS, how German banks articulate sectoral differentiation, whether firms respond by shifting to non-bank financing (capital markets/private credit), and whether the tighter stance impacts euro-area growth forecasts.

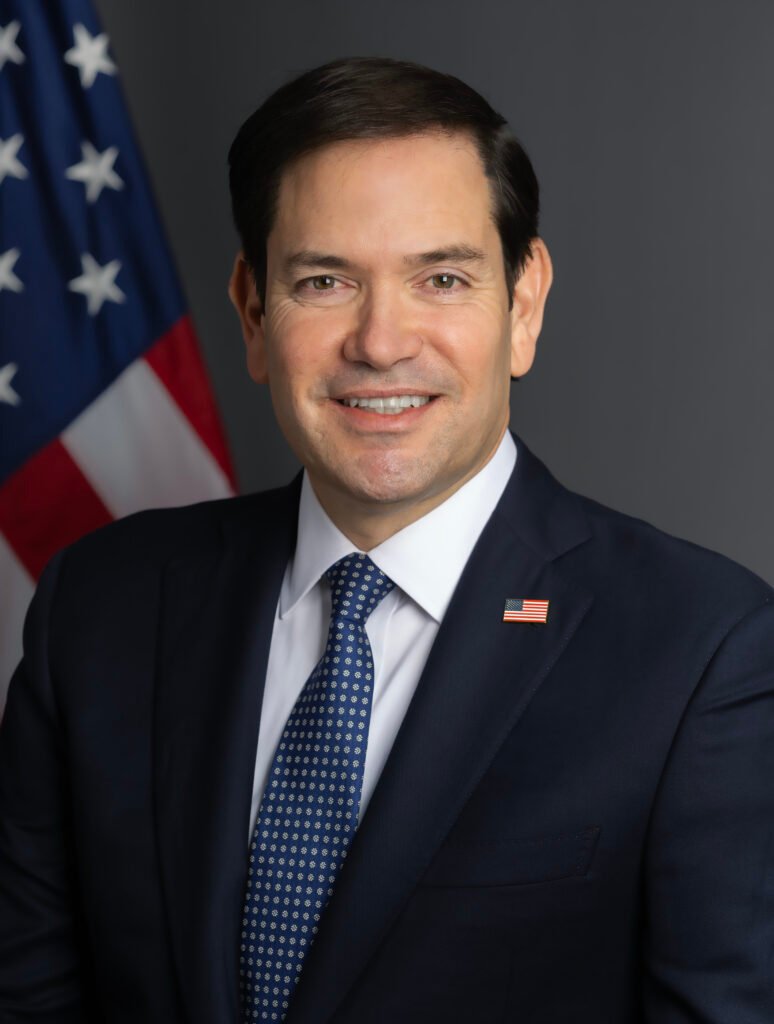

4. U.S. Secretary of State Readouts from Tokyo Meetings

The U.S. Department of State published a read-out today of Secretary Marco Rubio’s meetings in Tokyo with Japanese Foreign Minister Toshimitsu Motegi and other senior officials. State Department

Key points from the read-out:

- The meeting underscored strengthening the U.S.–Japan alliance in regional security, especially with respect to the Indo-Pacific and ensuring stability around Taiwan.

- Discussion also touched on economic coordination, including ensuring that the recently announced trade/investment framework (see Story 1) is implemented in a way that preserves broader alliance interests.

- Notably, the read-out includes mention of the issue of Japanese nationals abducted by North Korea and coordination of sanctions enforcement, showing a fusion of economic and security strands in the bilateral relationship. State Department

Why it matters:

These readouts reflect the evolving nature of U.S. diplomacy: trade, investment, security and human-rights are increasingly integrated. For Japan, the fact that its economic deal with the U.S. is tied to high-level security coordination signals that the economic agreement is as much geopolitical as it is commercial. For other allies, the message is clear: investing politics into trade deals.

What to watch: Whether Japan agrees to more coordinated sanctions or joint initiatives (e.g., supply-chain security) with the U.S., whether this signals a new model of bilateral economic/security pacts, and how China or regional actors interpret this deeper U.S.–Japan alignment.

5. U.S. Domestic Politics: House Judiciary Democrats Expand Probe of DOJ/Administration

The House Judiciary Committee Democrats issued a press release today announcing expanded demands on officials at the U.S. Department of Justice (DOJ), tied to allegations surrounding President Donald Trump and a proposed ~$230 million payout for investigations he faced. U.S. House Judiciary Committee Democrats+1

- The letter accuses top DOJ officials of being asked by Trump to execute a “blatantly illegal” plan to direct taxpayer funds to him personally as reimbursement for investigations. The Democrats are calling for recusal, document production, and investigation of both civil and criminal liability. U.S. House Judiciary Committee Democrats

- The press release aligns with previous coverage showing that House Democrats are preparing oversight and potentially impeachment-adjacent paths if they find misconduct. Courthouse News

Why it matters:

This story mixes legal governance, separation of powers and political accountability. If the DOJ is perceived as executing or being pressured to execute partisan demands, it raises foundational questions about the rule of law. For markets and regulatory watchers, this may forecast broader implications: legal risk, reputational risk for firms, potential shifts in enforcement priorities.

What to watch: Whether the committee issues subpoenas or refers matters for criminal investigation, how the White House/Trump world responds, and whether this escalates into public hearings with high visibility, which could influence public confidence and institutional norms.

Overall Takeaway

Today’s headlines reflect a world in transition: economic and investment diplomacy is ramping up (U.S.–Japan pact), global climate governance is showing strain (UNFCCC report), credit conditions in Europe are tilting cautiously, U.S.–Japan security-economy coordination is deepening, and U.S. domestic governance and oversight are under pressure.

Each item connects to larger themes: shifting trade-industrial alliances, the urgency of climate action, the interplay between macro-credit and growth, the fusion of diplomacy with economics, and the integrity of domestic institutions.