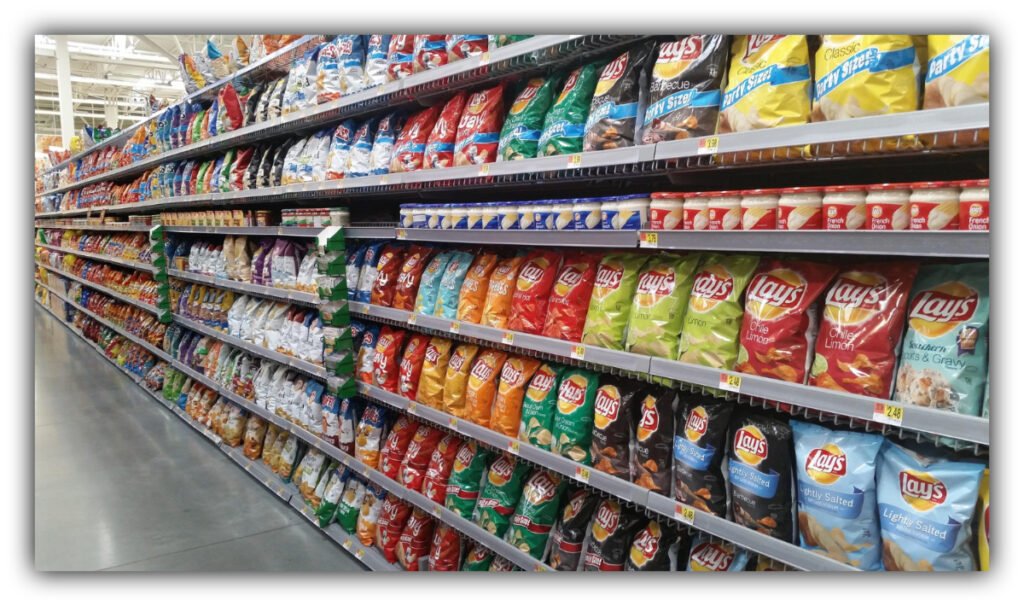

Doritos, Cheetos, and Lay’s potato chips, three of PepsiCo’s most iconic snack brands, now arriving on shelves with newly lowered suggested retail prices as the company works to boost affordability and demand. Photo courtesy PepsiCo.

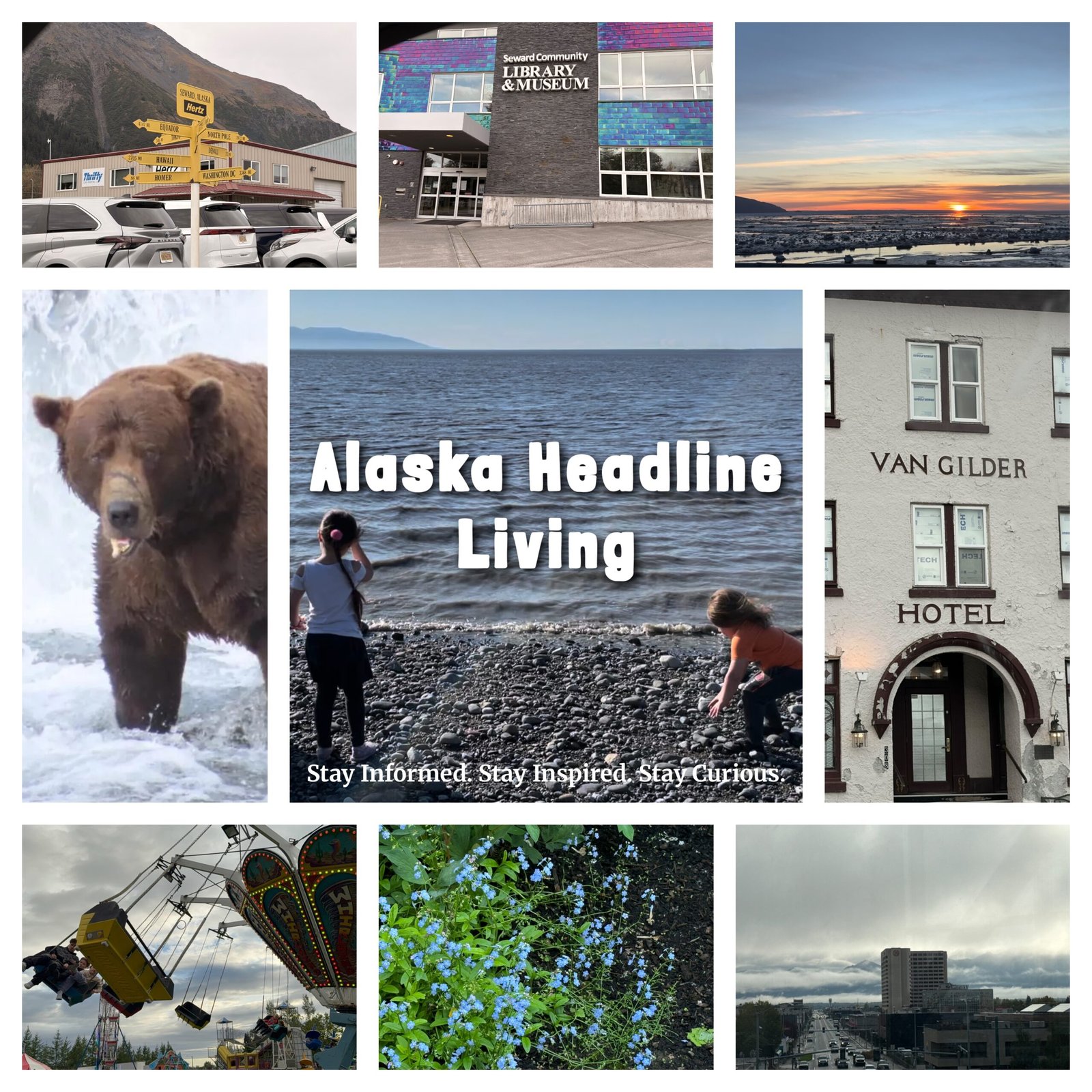

By Gina Hill | Alaska Headline Living | February 2026

When PepsiCo announced it was cutting prices on favorites like Lay’s, Doritos, Cheetos, and Tostitos by up to nearly 15 percent, the company framed it as listening to consumers feeling squeezed by rising costs. That is true. But it is not the whole story.

Behind the scenes, several financial and market pressures are pushing this move.

Snack Sales Have Softened

PepsiCo’s recent earnings show an important trend. Revenue has held up largely because of earlier price hikes, but actual snack sales volume has slipped. In plain terms, people are buying fewer bags of chips. Lower prices are a way to get shoppers back into the snack aisle and moving product again.

Consumers Are Trading Down

Inflation trained shoppers to look harder at price tags. Store brands and cheaper alternatives have gained ground, even against powerhouse names like Lay’s and Doritos. PepsiCo is responding to that reality by making its biggest brands more competitive with private labels.

Investor Pressure Is a Factor

PepsiCo has also been under pressure from activist investors who want stronger growth and better efficiency. Part of that push includes simplifying the product lineup, cutting underperforming items, and sharpening pricing on core brands that actually drive volume.

Cost Cuts Make Price Cuts Possible

The company has been streamlining operations, trimming its portfolio, and reducing complexity in manufacturing and distribution. Those savings help offset lower shelf prices without blowing a hole in profits.

Timing Matters

The price reductions are rolling out just ahead of peak snacking season, from winter gatherings to the Super Bowl. That is no accident. If you want to boost volume, this is the moment to do it.

The Bottom Line

PepsiCo’s price cuts are not just a goodwill gesture. They are a strategic reset. Slower sales, tougher competition, investor pressure, and a more cautious consumer all play a role. The company is betting that slightly cheaper chips now will mean more bags in carts, stronger loyalty, and healthier sales over the long run.

For shoppers, the reason may be complicated. The result is simple. Your favorite snacks should cost a little less.