By Gina Hill | Alaska Headline Living | January 2026

Alaska’s housing market enters 2026 with a split personality. On paper, inventory is improving. In reality, where you live still determines how many options you actually have. Nowhere is that contrast clearer than between Anchorage and the Matanuska-Susitna Borough.

Local brokers, national housing data, and statewide trends all point to the same conclusion: the Valley continues to carry a disproportionate share of Alaska’s available homes, while Anchorage remains supply-constrained relative to its population.

A Tale of Two Markets

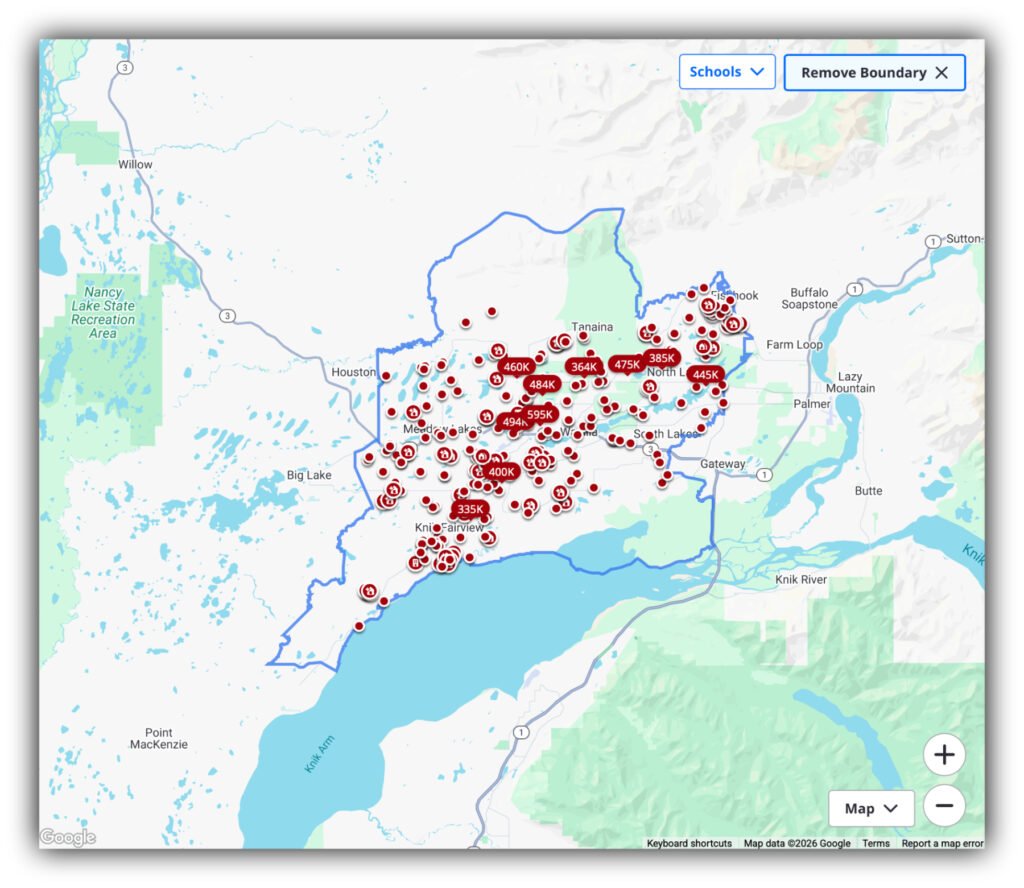

In the Matanuska-Susitna Borough, there are currently about 460 homes on the market. Roughly 97 of those were built in 2025, meaning about 21 percent of all listings are brand-new construction. That level of new housing has been consistent for several years, and it reinforces a long-standing trend. Most of Alaska’s new single-family homes are built in the Valley.

The Valley’s population is about 120,000. With current inventory levels, that works out to nearly four homes for sale per 1,000 residents.

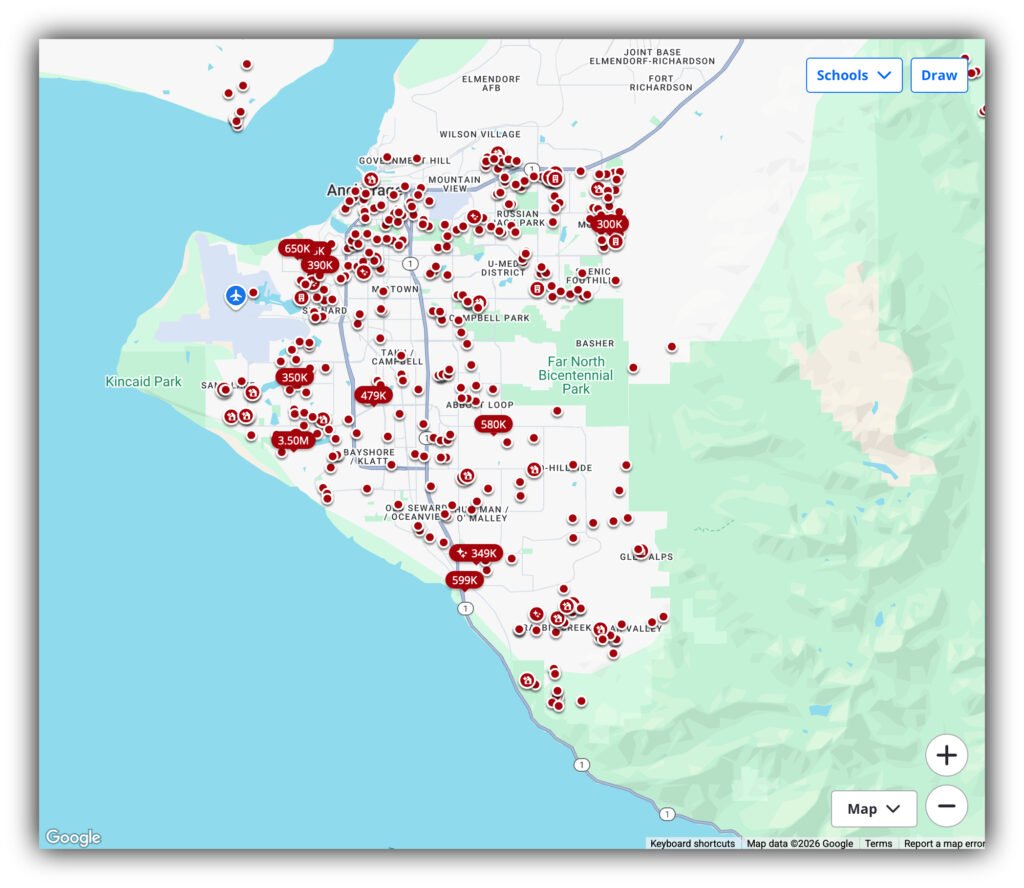

Anchorage tells a very different story. With a population of about 290,000, the city has roughly 297 homes on the market, depending on the data source and how listings are counted. Of those, about 34 were built in 2025. That puts new construction at roughly 12 percent of listings, close to the national average and far below the Valley’s share.

On a per-capita basis, Anchorage has about one home for sale per 1,000 people. The Valley has roughly four. Relative to population, Valley buyers have about four times as many options.

Why the Valley Keeps Building

Land availability remains the Valley’s biggest advantage. Larger parcels, fewer zoning constraints, and a development pattern built around single-family homes have allowed builders to keep producing new housing even as costs rise.

That steady construction has helped keep inventory healthier, at least by Alaska standards. Median sale prices in the Valley are still substantial, generally in the low to mid $400,000 range, but buyers tend to have more choices and slightly less competition than in Anchorage. Homes are also spending longer on the market than they did during the pandemic peak, suggesting a gradual shift toward balance.

Population growth continues to support demand. As housing costs in Anchorage remain high, many buyers look north for more space and newer homes, reinforcing the Valley’s role as Alaska’s primary growth corridor.

Anchorage Remains Constrained

Anchorage’s housing pressure is structural. The city is older, denser, and far more limited in where and how it can build. New construction exists, but it makes up a smaller share of listings, and permitting timelines remain slow.

Prices reflect that tightness. Median sale prices hover around $420,000, with some listings pushing well above that. Inventory remains low relative to population, and months of supply are consistently below what economists consider a balanced market.

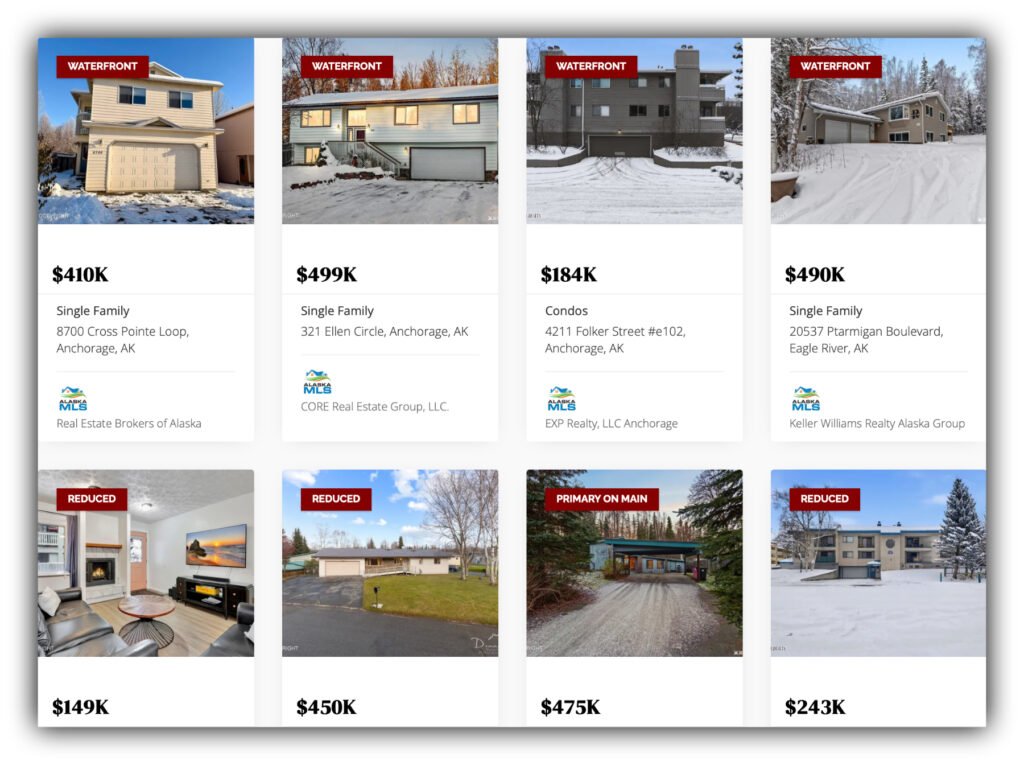

Prices cluster near the median, including a $499K E Street home, $184K Water Street condo, and $490K Tudor family option, many reduced amid winter slowdowns. Via AlaskaHomeSearch.com.

Even when listings increase slightly, demand quickly absorbs them. Well-priced homes still move fast, especially in established neighborhoods.

The Statewide Picture

Across Alaska, housing inventory has ticked up modestly, but supply remains limited compared with demand. Average home values statewide rose about 3 to 4 percent year over year through late 2025. That pace is expected to continue through 2026 rather than accelerate or reverse.

Mortgage rates are likely to ease slightly from recent highs, but they will remain elevated compared with the last decade. That limits how many buyers can enter the market, especially first-time buyers, and keeps affordability strained even where inventory improves.

Rents continue to rise statewide, which pushes more households toward ownership when possible and keeps pressure on the for-sale market.

Regional Forecasts for 2026

Anchorage is expected to see modest price increases or stabilization rather than a correction. Inventory should improve slowly as new construction and resale listings come online, but supply will remain tight relative to population.

The Mat-Su Valley is likely to remain Alaska’s most balanced market. Continued construction should keep inventory healthier than Anchorage’s, and prices are expected to rise gradually rather than sharply.

Fairbanks is projected to see slow, steady price growth supported by stable employment and limited inventory. The market there remains more balanced than Southcentral Alaska.

Juneau’s constrained geography continues to limit supply. Prices are expected to edge up slowly, supported by steady demand tied to government and tourism employment.

What This Means Going Forward

Alaska’s housing market is not headed for a crash, nor is it returning to the frenzied conditions of the pandemic years. Instead, it is settling into a slower, tighter reality shaped by geography, construction patterns, and affordability limits.

The Valley will likely continue to carry the burden of new housing production, offering more choices per person and slightly less pressure on buyers. Anchorage will remain competitive, with fewer options and higher prices relative to population.

For buyers, 2026 may bring more breathing room than the past two years, especially outside Anchorage. For sellers, prices should remain stable to modestly rising, but unrealistic expectations are likely to meet resistance.

The gap between where Alaska builds and where Alaskans live remains the defining feature of the market, and for now, that gap shows no sign of closing.